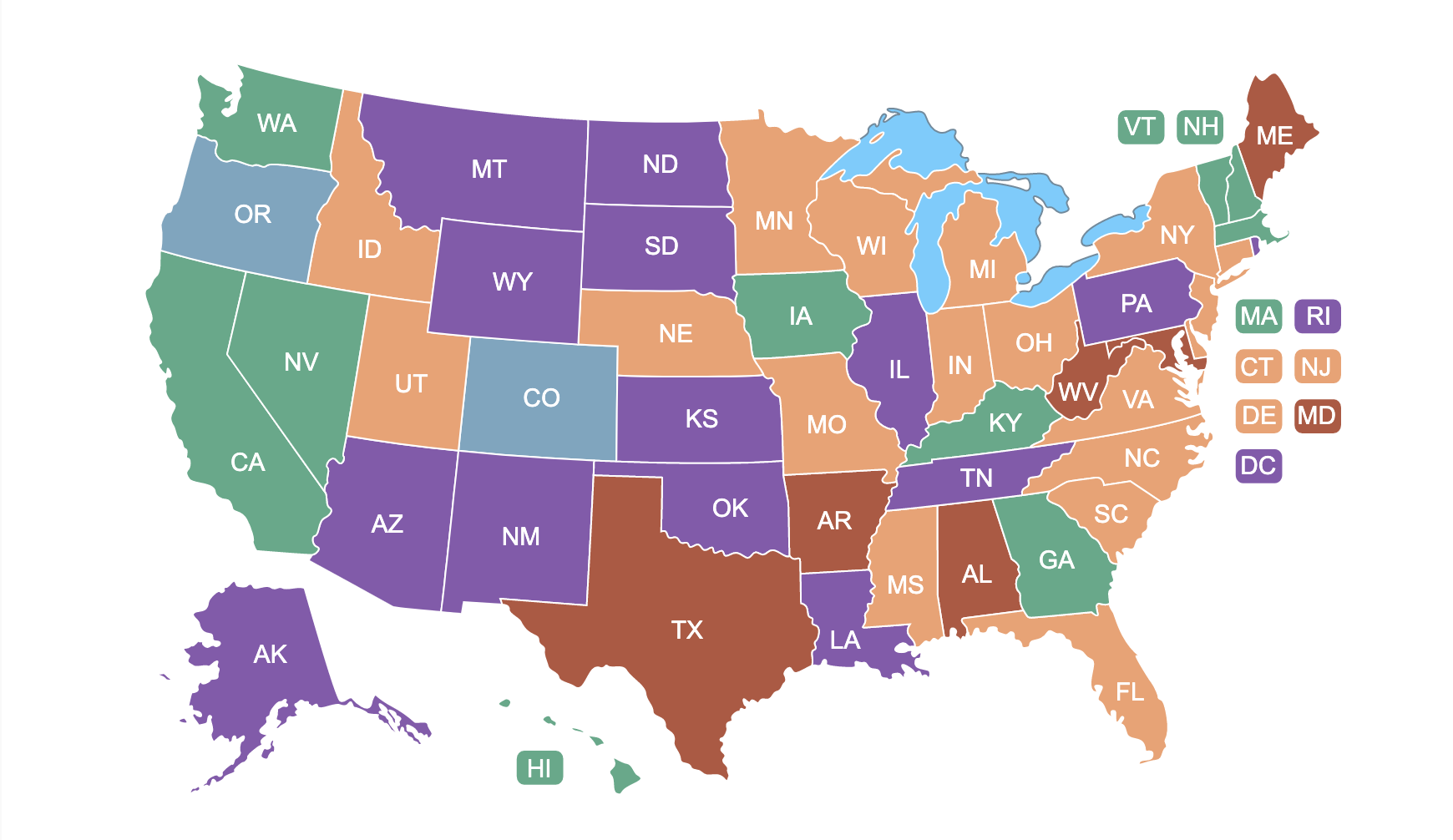

Click here to go to our US Map of Workers’ Compensation!

Have you ever wondered what version of the AMA guides are used in South Dakota? How many states use a state specific ruleset for determining impairment? What is the oldest version of the AMA Guides in use?

Whether you need a question answered for your workers’ comp practice, or you’re just plain curious, we have a map for you!

The RateFast US Map of Impairment Rules

back in 2018 we put this map together to give any party in a work comp claim access to their state’s rule set, as well as some resources that will help them smooth the work comp process.

5 years later, we are still maintaining that US map, and want to make sure that you know that it’s there!

Updates

We have recently updated the map with a helpful key, in order to more clearly read the map and find your state’s ruleset.

It is also important that we make sure that the map is always up to date, so we make an effort to regularly maintain our map page.

Conclusion

Sometimes work comp providers operate in a different state than their patient’s injury. Adjusters and other parties often work across state lines. There are many situations where one might need a US map of workers’ comp state rules, and we’re happy to provide it!