You want your patients to get the treatments that you’ve ordered for them. Quickly. With as little hassle as possible.

Unfortunately, in the world of work comp, getting an insurance carrier to authorize what you’ve ordered for your patient isn’t always simple.

This article is about how you, as a medical provider, can write medical reports and RFAs that get services authorized for your patient.

(If you want to learn more about RFAs, then click here).

What Utilization Review Wants to Know

When you send your request to your patient’s insurance carrier, then the insurance company’s Utilization Review team (UR) reviews the RFA and—the accompanying visit note—to determine whether or not the treatment should be authorized. Here’s what you can do to help your RFA get approved.

1. Complete the RFA as thoroughly as possible.

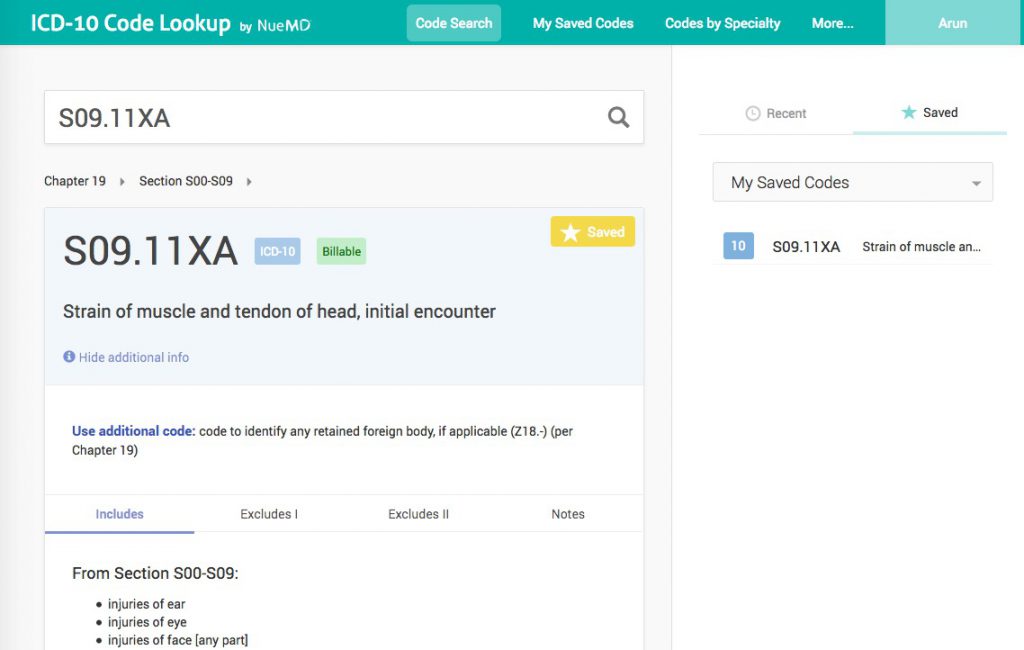

Each RFA should include diagnostic codes of the patient’s condition(s), the service/good/treatment that is being requested, and any supporting details. Failure to include any of this information may result in the insurance carrier sending the RFA back to the provider.

Also, ensure that the physician has signed the RFA. Nurse practitioners and Physician’s assistants should not sign RFAs.

2. Include the full medical report with the RFA.

An RFA is very difficult to authorize without context. Therefore, send the RFA and the workers’ comp report together, and make sure that the report supports the RFA. The information in the report should be consistent with the RFA and be crystal clear to the claims adjuster who reads teh report.

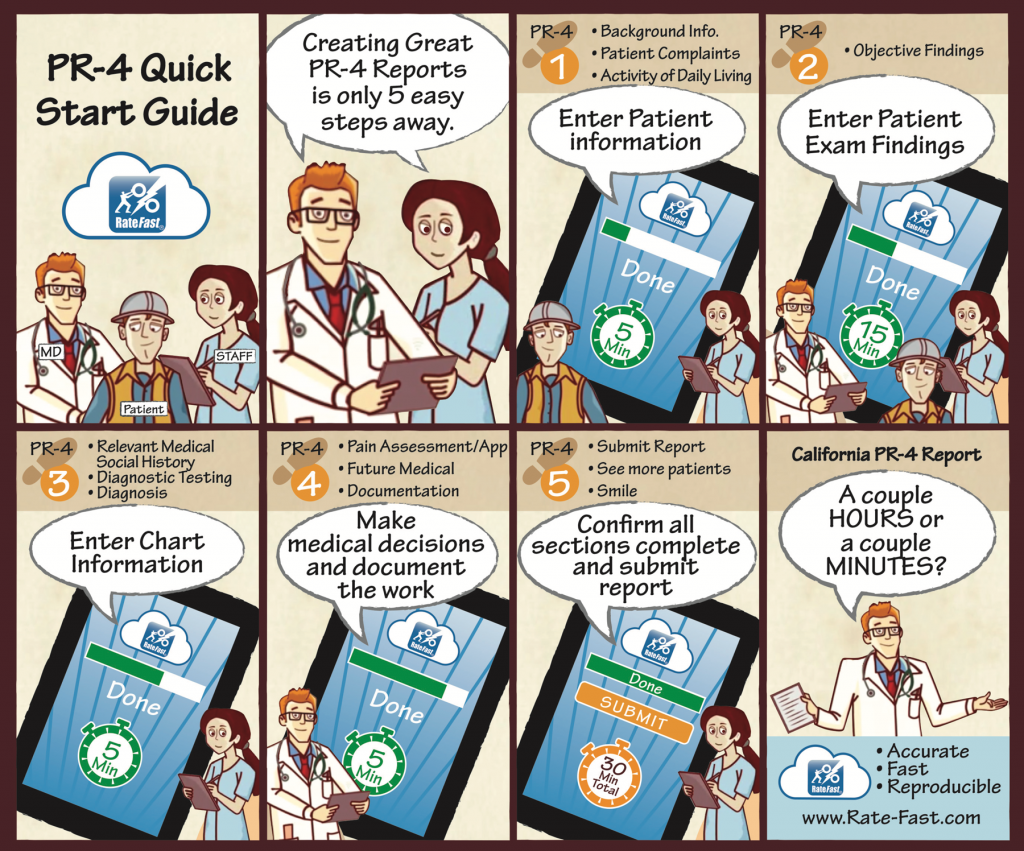

If you use RateFast to write your workers’ compensation reports (Doctor’s First, PR-2, and PR-4 reports), then RFAs will automatically be included at the end of the report as you select treatments, referrals, medical equipment, and other services for your patient while completing the RateFast report.

3. Include the medical history.

Include a list of all treatments used, the patient’s response to the treatment, self-care, home-exercise programs, and so forth.

Reports written in RateFast will always include this information, so long as you complete the “Subjective Complaints” and “Medical History” sections of each RateFast report.

4. Tell a convincing story.

Together, your RFA and workers’ comp report should make a persuasive case that the medication, therapy, equipment, or other treatment that you are requesting will benefit your patient.

For example, if you are requesting authorization for a treatment that the patient has already used, then your report needs to demonstrate that the treatment has helped the patient in the past.

To understand the full story, the UR department needs to know answers to the following questions:

- Is the patient feeling better?

- Has the patient improved functionally improved? In other words, is their range of motion, flexibility, and/or strength measurably improved?

- Is the patient complying with the current treatments?

- How are the current treatments affecting the patient’s activities of daily living?

- If a patient stopped receiving a treatment, is the condition now worsening as a result of no longer receiving that treatment?

In order to answer these questions, it’s important to include information about all changes—or lack of changes—in the patient’s condition. This would usually be described in a PR-2 report (Physician’s Progress report). If you use RateFast to write your PR-2 reports, then you’ll be prompted by the software to make a note of all changes.

Conclusion

Answer these questions and your RFA will be a cut above the rest.

For real-life examples and details given by Dr. Alchemy, MD, QME, tune into our podcast on RFAs and Utilization Review.

Click here to learn more about how RateFast users can automatically fill out RFAs while writing reports.

Try RateFast Express today!